city of cincinnati tax return 2020

E-File provides an easy-to-use system that allows businesses to make withholding and estimated tax payments through ACH Debit. If you are a resident of the city of Cincinnati you may not allocate days worked out of the city.

Opinion The Coronavirus And The Cities We Need The New York Times

City of cincinnati tax requirements.

. Files submitted on diskette must have MSDOS carriage return line feed pairs at the end of the record. May 11 2020 Agency. PO Box 637876 Cincinnati OH 45263-7876 Returns must be filed by everyone required to submit a Declaration of Estimated Tax even though the Declaration was accurate and paid in full.

Click on the fields below and type in your information. The Ohio First District Court of Appeals recently addressed whether a City of Cincinnati tax ordinance which set forth the requirements for filing consolidated City income tax returns was preempted by a state statute. Tax Return Instructions Use this form if you are an individual who receives wages reported on Form W-2 and you are claiming a refund.

We offer E-File for the annual tax returns for individuals and the option of making a payment. The account information contained within this web site is generated from computerized records maintained by the city of cincinnati. The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati.

Beard Revered Beard Humor Long Beard Styles Awesome Beards Facebook Twitter Youtube Instagram Linkedin. 2020 2021 Income Tax Rate set at 0525 At the December 21 2020 Council meeting Village Council voted to pass its annual Income Tax Ordinance which maintained the tax rate of 0525 as provided in Section 93A-03 of the Code of Ordinances. To the best of my knowledge and belief all other filing and payment requirements have been fulfilled.

Microsoft Word - 2012 Individual Return revised 10222012doc Author. Get OH Individual Tax Return - Cincinnati 2020-2022. CITY OF CINCINNATI INCOME TAX BUREAU 805 CENTRAL AVENUE SUITE 600 CINCINNATI OH 45202-5756.

To the City of Cincinnati Income Tax Division CITY OF CINCINNATI INCOME TAX DIVISION 805 CENTRAL AVENUE SUITE 600. Detailed Ohio Development. Tax Return is due by.

Use a cincinnati tax forms 2020 template to make your document workflow more streamlined. CITY OF CINCINNATI 2020 BUSINESS INCOME TAX RETURN INSTRUCTIONS Office Phone. At 21 the city of Cincinnati has the highest income tax in the region and tens of thousands of jobs held by people who do not live within its corporate limits.

Then print the form and mail it to our officeCity of CincinnatiIndividual Tax Return 2020TO EXPEDITE PROCESSING PLEASE DO NOT STAPLE Account. 2020 business income tax return filing required even if no tax due due on or before april 15 2021 or within 3½ months from end of fiscal year beginning _____ and ending _____ federal id no. Do not place a CRLF in the middle of a record and do not include blank records.

Vandalia OH 45377 Phone. Tax rate for nonresidents who work in Cincinnati. City of cincinnati tax return 2020 Friday March 18 2022 For example we may disclose your tax information to the Department of Justice for civil and criminal.

2020 Tax Forms In addition to the forms below Cincinnati tax forms are available at our office at 805 Central Avenue Suite 600 Cincinnati OH. Rate City Of Cincinnati The Best Template And Form as 5 stars Rate City Of Cincinnati The Best Template And Form as 4 stars Rate City Of Cincinnati The Best. Start putting your signature on tax return cincinnati form by means of solution and become.

Generally everyone who lives or works in cincinnati should file a cincinnati income tax return. Box 634580 Cincinnati OH 45263-4580. Employers can also use this application to E-File their year-end withholding reconciliation and to.

Cincinnati Income Tax Division PO. Nonresidents who work in Cincinnati also pay a local income tax of 210 the same as the local income tax paid by residents. Individual Tax Return.

Income Tax Office PO. Filing Requirements All Cincinnati residents regardless of your age or income level who receive taxable compensation are required to pay the City of Cincinnati income tax at the rate of 18 effective 100220 and 21 prior to 100220. Finance Budget Menu.

Use the Individual. The rate for 2020 taxes is525. Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal income tax.

Mail all payment coupons to. The taxpayer filed an amended consolidated Cincinnati income tax return which included the. FORM BR file with.

Pay online if you do not want to use a printed form. Box 727 333 JE. The tax rate remains the same for the tax year 2020 and was also set prospectively at 0525 for the tax year 2021.

Therefore there is no refund opportunity when filing a tax return for 2020 if you were working at home due to Covid-19. While every effort is made to assure the data is accurate and current it must be accepted and used by the recipient with the understanding that no warranties expressed or implied concerning the accuracy reliability or suitability of this data have been. Line 5 Multiply the amount of Line 3 or Line 4 by 21.

Cincinnati Income Tax Return for the taxpayer account name and account number listed below. To have tax forms mailed to you or with questions please call.

2020 Where To Mail 941 Wisconsin West Virginia Rhode Island

Ohio Tax Advice What To Know About 2022 Work From Home Refund

Pin By Kay Reeves On My Death Book Estate Planning Checklist Funeral Planning Funeral Planning Checklist

I Made Phone Wallpapers Based On The Jerseys Of Every Nfl Team With Throwbacks As An Added Bonus Im Chiefs Wallpaper Kansas City Chiefs Football Nfl Teams

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Chiefs Kansas City Chiefs Kansas City Chiefs Football Kansas City

Nfl Week 1 Pick Em Sheet In Color Nfl Week 1 Nfl Nfl Weekly Picks

Must Be Small Fry Season At The Irs State College Pa

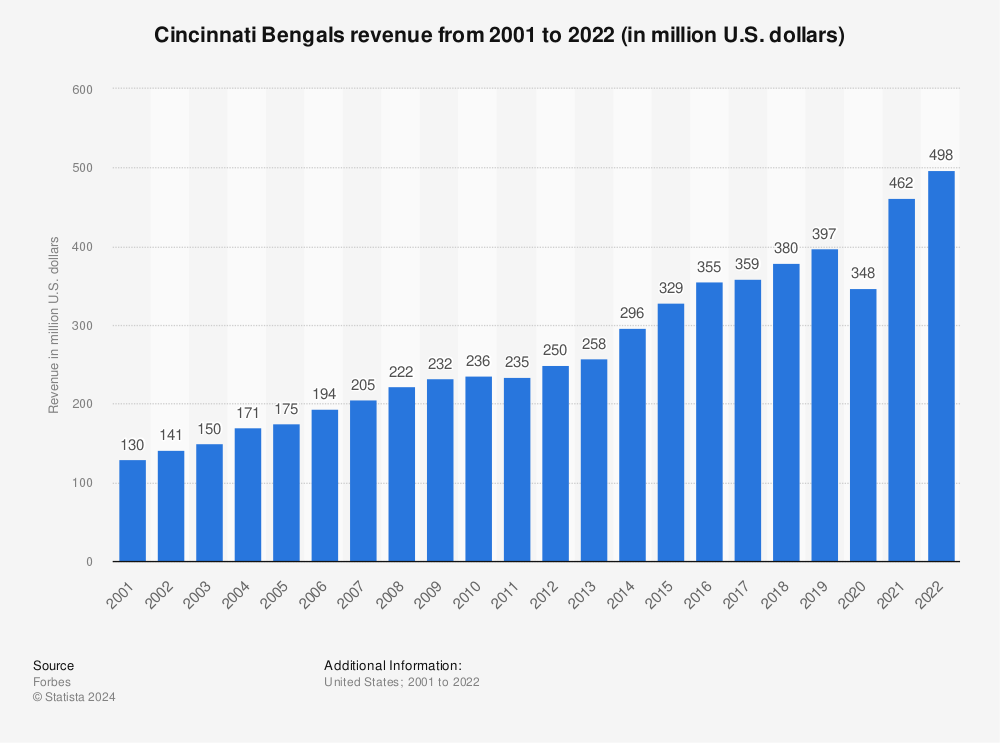

Cincinnati Bengals Revenue 2020 Statista

513 275 8397 Winning The Lottery Lottery National Insurance

Free Image On Pixabay Buildings Bridge Illuminated New York City Vacation New York Vacation Solo Travel

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

The Fed Just Pulled Off Another Backdoor Bailout Of Wall Street Counterpunch Org In 2020 Cash Management Pull Off Chartered Financial Analyst

Ohio Income Tax Refund For Working From Home Gudorf Tax Group

Pin By Alvaro Martinez Naranjo On The Bolts Los Angeles Chargers San Diego Chargers Chargers